February 20, 2026

Ag Partners Grain Text

Weekly futures changes:

CH26 – 4.5

SH26 + 3.75

Nearby Basis Bids:

Atch -3H

CGB -25H

AGP -45H

KC -30H

Notes:

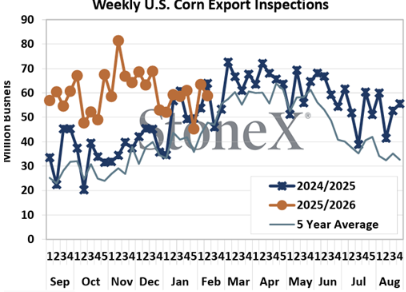

This week’s corn inspections were down a little from last week but still very solid at 58.8 million bushels.

- The key talking point that will continue to come up until the USDA releases its planted acres report on June 30 is just how large the next crop could be—especially considering the sizable carryout from the most recent harvest, which is projected to exceed 2.2 billion bushels.

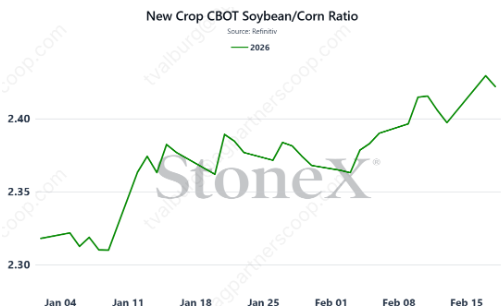

- When looking strictly at the new crop futures prices, it looks to favor planted corn acres again this year, although the trend has shifted the past few weeks.

- While a 2.5 to 2.6 ratio has traditionally been viewed as the dividing line between favoring corn or soybeans, you also have to factor in the corn-to-fertilizer ratio and how that influences the decision.

- When looking strictly at the new crop futures prices, it looks to favor planted corn acres again this year, although the trend has shifted the past few weeks.

When looking at those ratios, urea, UAN, NH₃, and phosphate relative to corn prices are at their second-worst levels on record

The USDA released their unofficial Ag Forum early estimates this week, and their initial guess is 94 million acres (the exact same number from last year’s ag forum) with a trend line yield of 183 bushels per acre giving us a 15.755 billion bushel corn harvest.

The way crop insurance is playing out, there are a lot of arguments about those figures being light

The Ag Forum’s soybean acres came in at 85 million acres, up from 84 million last February. The left yield at 53 bushels per acre making the total harvested bushels 4.45 billion bushels.

Keep in mind, the Ag Forum numbers were merely those of economists working in the USDA offices, with no input from farmers or the industry.

Speaking of crop insurance, we’re past the halfway point for the averaging period for the February Insurance values and so far, the corn average is $4.59125 and $10.9775 for beans.

New crop board crush continues to climb higher. SMZ/BOZ/SX was over $2 this week

The rally in board crush is mainly due to December soybean oil rallying nearly 18% since the start of the new year.

Tensions continue to mount between the United States and Iran as President Trump moves military assets into the region seeking to push Iran into a nuclear agreement

For its part, Iran scheduled military exercises in the Strait of Hormuz that are expected to partially shut down the Strait this week. A fifth of the world’s crude oil moves through the Strait, along with a third of the world’s urea fertilizer, nearly a fourth of its anhydrous ammonia fertilizer, and most of the phosphate that the United States imports.

The United States has Naval assets in the region to help keep the 11-mile-wide passage flowing for global trade

The Lunar New Year holiday continues in China this week, stretching through Monday, February 23. As such, we’re not likely to hear much market-moving news out of China this week.

Another week passed without the EPA sending its final biofuel regulations to the White House Office of Management and Budget for review, Although the EPA continues to state that it will release the final regulations in the first quarter of this year.

The industry can’t afford much more of a delay. Both soybean and soybean oil prices rallied in recent weeks in anticipation of the regulation release. That money flow needs to see something positive soon in order to sustain that momentum

The Nopa crush report came in larger than expected this week at 221.6 mbu vs 218.5 mbu estimate

Corn and soybean basis pretty much unchanged week over week. Trucks continue to hit the roads and based on the weather forecast, that most likely will continue. With first notice day approaching for March futures, nearby values will begin rolling to May next week. We would assume bids will take some of the spread.

If you no longer wish to receive texts of this nature in the future, please reply ‘STOP’.